Streamlining Employee Benefit Policy Sales for Insurance Brokers

A prominent commercial insurance brokerage firm, which specialized in employee benefit programs for a diverse clientele and extensive portfolio, faced a significant challenge.

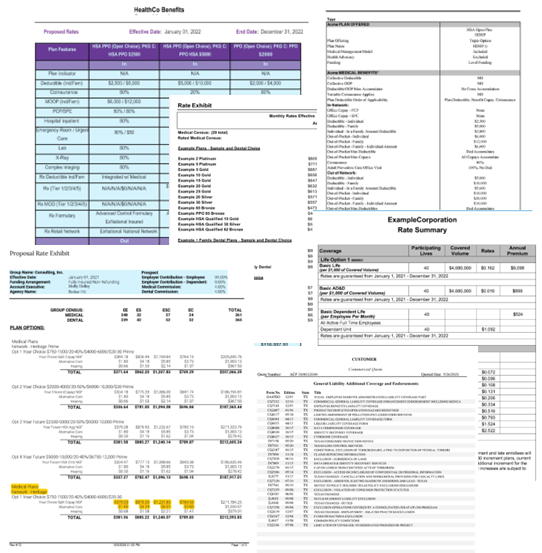

Every year, when carriers rolled out their new coverage plans, the brokerage needed to efficiently extract detailed information about the many coverage plan elements from the myriad of policies updated by dozens of individual insurance carriers. -So that in a limited time window, the brokers can understand what to explain, change, or sell to their customers.

Each carrier's policies varied in format and terminology, making the extraction process complex and time-consuming.

The objective was to compile these details into a single, comprehensive report to aid in determining the most suitable policies for their clients, and accelerate the firm’s ability to close coverage plans for individual commercial customers.

The Challenge

The brokerage's original manual process for extracting policy information was labor-intensive and prone to errors. They needed a solution that could accurately and consistently extract the necessary data from a wide range of plan documents thta look like marketing brochures. Initially, the brokerage explored various technology products, including optical character recognition (OCR) tools and generic data extraction software as an alternative to temp labor, or offshore support. However, none of these solutions met their needs in terms of accuracy and flexibility. The tools often struggled with the varied formats, tables, and complex language used in insurance plans, resulting in incomplete or incorrect data extraction.

Technology Exploration

The brokerage invested considerable time and resources in testing different technology products. They also experimented with AI-based data extraction software, which showed some promise but lacked the customization needed to handle the specific nuances of insurance policy documents. Each failed attempt underscored the complexity of their requirements and the necessity for a solution that was both sophisticated and easy to use.

In their search for a more effective tool, the brokerage came across Docugami. Intrigued by its potential, the brokerage decided to trial Docugami to see if it could address their specific needs. The initial demonstrations and pilot projects indicated that Docugami offered a level of precision and adaptability that previous solutions lacked.

Implementation of Docugami

The brokerage began integrating Docugami into their workflow. The implementation process was straightforward, as Docugami is designed for use by non-technical frontline staff, without the need for IT deployment, user training, or changes to existing business processes. Brokers appreciated Docugami’s ability to learn from each document as well as any user feedback, and further improve its data extraction capabilities over time. Docugami's machine learning algorithms quickly adapted to the diverse formats and terminologies used in the insurance policies, significantly enhancing accuracy.

Enhanced Client Service

With Docugami, the brokerage saw significant improvement in data extraction accuracy and efficiency. New plan information flows into a universal spreadsheet for brokers to reference. This improvement not only saved time and reduced the potential for errors but also allowed the brokerage to better serve their clients by providing more accurate and timely information. - and to beat their competitors to the sale or renewal.

Improved Employee Experience

The ability to quickly and accurately assemble detailed coverage information into a single report had a positive impact in several ways – more accurate policy comparison reports, rapid time to customers, less time spent on tedious and error-prone data extraction, and higher employee sales.

Creating a Competitive Advantage

Docugami proved to be the transformative solution that the commercial insurance brokerage had been seeking. With unparalleled precision, accuracy, and ease of use, Docugami enabled the brokerage to turn the annual policy compilation process from a tedious burden into a competitive advantage.

Schedule a Demo

Ready to see how AI-powered Document Engineering can streamline your operations and deliver superior insights? Our team is eager to show you how our Document Engineering software can be tailored to your unique challenges and goals.